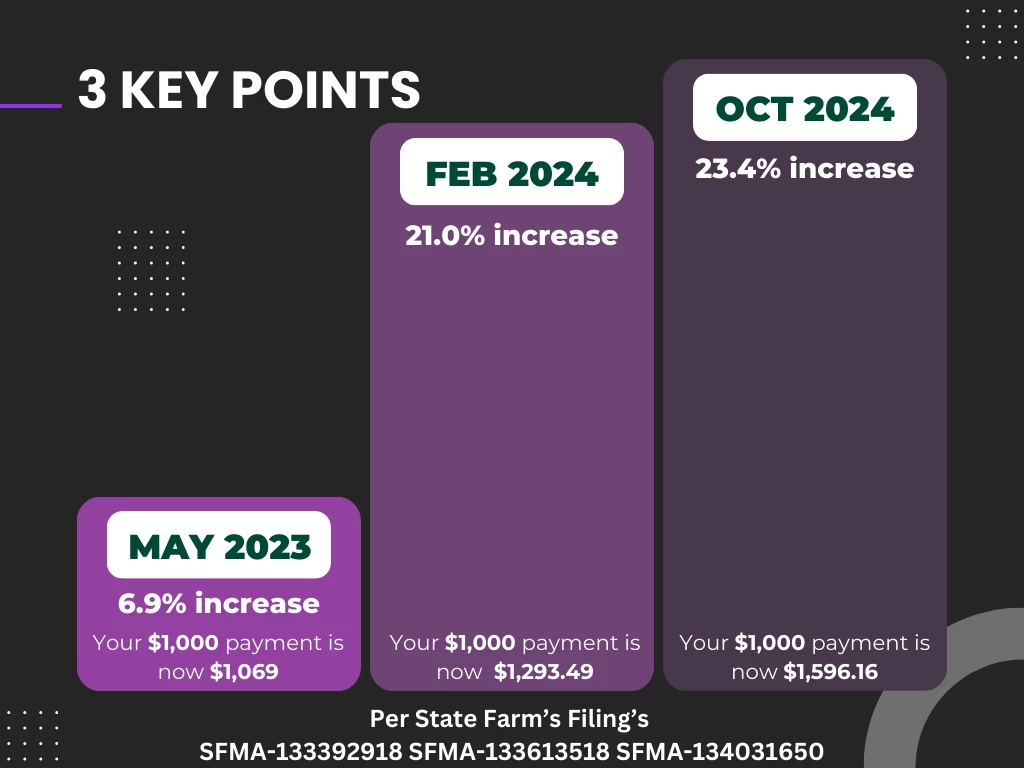

Brief History:

Since 2021, State Farm auto insurance rates in California have surged by nearly 60%. For example, if you were paying $1,000 in 2022, the three recent increases will bring it to $1,596.16 for your renewal starting October 2024.

Three recent increases:

- 1

May 15, 2023

6.9% average increase already happened. - 2

February 26, 2024

21% average increase effective when your policy renews after February 26, 2024. - 3

October 1, 2024

23.4% average future increase effective when your policy renews after October 1, 2024.

Try our calculator to see for yourself:

New Premium:

$2394

This calculator tool is only an estimate. The input value is multiplied by 1.596

State Farm isn't raising prices due to poor management; they are responding to a mathematical problem where losses far exceed revenue. Many drivers, like myself, have driven less over the past few years. So why such significant increases?

What to expect for the October 2024 increase:

Renewals after October 1, 2024 will also have a significant increase. An average of 23.4%. Whose premium will go up more?

Liability only vehicles will see a significant increase. Our estimate is between 30%-40%. We base this estimate on State Farm’s Filing which reports that Bodily Injury/Property Damage premiums will increase by 37.3% on average. With Uninsured Motorist premiums increasing by 43%.

2016-2021 Kia and Hyundai vehicles. We’d love to hear from you how much your premium increases in October 2024. State Farm reports in a filing that they saw a significant increase in thefts for 2016-2021 Kia and Hyundai cars

Let's look how much State Farm paid out in just thefts for 2016-2021 Kias and Hyundais over the years:

2020 - $8.8 million.

2021 - $21.1 million.

2022 - $74.3 million.

We don’t have 2023 or 2024 data, and that data might never be shared publicly, but we can only assume that this is a $60 million unexpected drain on the company, per year! There was about 1/10th of that amount just a few years ago.2021 - $21.1 million.

2022 - $74.3 million.

State Farm's 2024 Financial Info

Nationwide, State Farm reported a loss for auto insurance in 2023 of $9.7 billion. Source

Why is State Farm increasing premiums in California this year? It’s because State Farm isn’t profitable.

Isn't Profitable? Should I be worried?

No, insurance companies themselves have insurance, called re-insurance. And on top of that the California Insurance Guarantee Association (CIGA) is run by the state of California and will pay your claims if State Farm goes bankrupt.

No, insurance companies themselves have insurance, called re-insurance. And on top of that the California Insurance Guarantee Association (CIGA) is run by the state of California and will pay your claims if State Farm goes bankrupt.

Should you expect more increases? While we don’t know for sure we don't expect so. Their math indicated that they should increase prices 28.4% but only did 23.4%. It is possible that there could be slight increases ahead, but unlikely until after October 2025. It’s also possible that these losses the past 2 years are abnormal and will slow in the future resulting in prices stabilizing. Normal increases in California are 6.9% or lower. Generally there is huge pushback for increases of this magnitude, but there was a lull in increases the past few years, and then a spike in losses recently. It's hard to argue against the increases when the company lost billions last year and increased less than their models projected.

State Farm is still a Strong Company. Other companies are facing similar issues these past years. Other companies are raising prices as well.

So what can you do?

Well, the first thing I’d do is contact my State Farm Agent! State Farm agents only work with State Farm so you’ll get good advice on what your options are if you stick with State Farm.

Once you know your final price and decision on what coverages you want with State Farm, you should try to get quotes elsewhere. Prices have gone up. Good luck.

Brian Abbott

May 27, 2024

Our sources

- State Farm Prior Approval Rate Application For Property & Liability Lines General Information documents filed with the Department of Insurance on 09/14/2022, 03/07/2023, and 02/08/2024.

- CDI File numbers: SFMA-133392918 SFMA-133613518 SFMA-134031650

- Related NAIC Company Code: 25178

- Related NAIC Group Code: 176