223 California car insurance companies.

Billions spent on marketing.

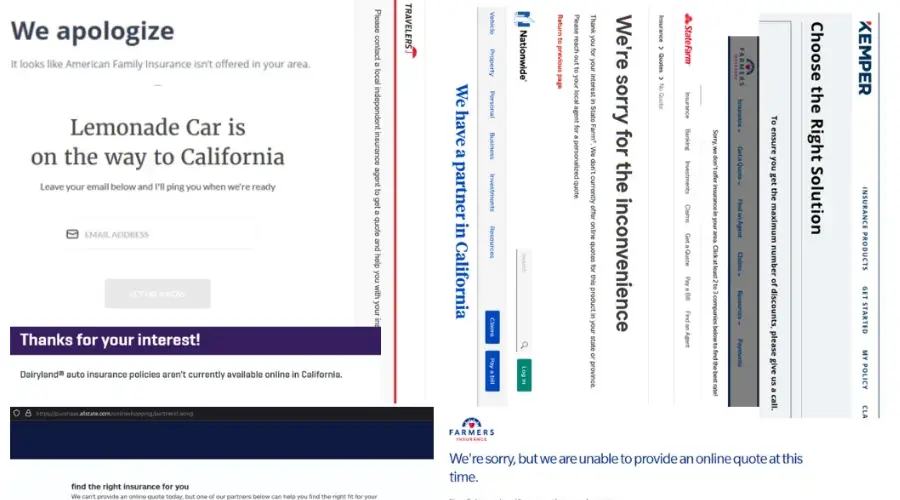

And yet, only 7 online quotes are available to me.

The Facts at a Glance:

- 1

Online quotes are becoming a thing of the past.

- 2

Insurance companies are less profitable than previously.

- 3

California good drivers have the right to choose their company. (So why is it so hard?!)

What's going on?

I’ve never had a ticket or accident in my life and worked in the insurance industry for over 10 years, so not being able to get quotes online from companies is surprising and embarrassing.

You may find yourself in a familiar situation; you’ve entered all your personal information looking for car insurance only to be told to "call us", or that you’re not eligible. Shopping for car insurance in 2024 has become an impossible task to do alone. You deserve better. Below is a deep dive into how it got like this, what you can do today to navigate the market, and how we can demand change for the future.

How we got here:

Insurance companies are struggling with profitability. Quite bluntly that’s the reason we think they don’t want to offer quotes online at this time. We believe that many insurance companies are trying to make their existing customers more profitable. Obtaining new customers is seen as a problem in their eyes because their current system is not performing the way they’d like. And again, quite bluntly, 6% inflation was unexpected; the models the insurance companies relied on had incorrectly assumed inflation would be lower resulting in companies being less profitable.

2020 also introduced volatility into what has been a stable auto insurance system. In the beginning companies were much more profitable because there was less driving and consequently less accidents. However, that quickly changed when inflation hit a high. Everyday businesses like repair shops and law offices responded by raising prices. This means more cost for insurance companies. This volatility also has made these cautious companies even more hesitant of risk. They want to err on the side of profitability.

Profits profits profits. Does this have anything to do with me getting a quote online? It shouldn’t - and companies may claim it’s for a different reason. It appears to us that the insurance companies in California are figuratively closing their doors to new customers while they re-work internally to become more profitable.

Okay. I can’t get quotes online. What’s next?

Acceptance. We can control what we can control. We can not get these quotes online today. So there are other methods available today while QuoteMingle works behind the scenes to offer you more quotes.

We’ve put together a comprehensive guide with information on every insurance group in California. I highly suggest it. https://quotemingle.com/#guide ↗

Phone - This seems to be the preferred method by the insurance companies. They want you to call them and get a quote on the phone. Make them email you the quote when you are done so you can review coverages before you buy.

Agencies - Insurance agencies can be viewed as the mom-and-pop stores for the big insurance companies. There are two types:

Captive agencies can only offer one company, and while that may be a slight downside while shopping for insurance, it is a huge benefit for you once you are a customer. Captive agents are extremely knowledgeable about their products and may have a deeper insight into the product than independent agents have with all their offerings.

Independent agencies may not be limited to one company and have access to a broader market, but they may still narrow their search for you based on which companies they think may be most successful. (You probably don’t want companies tailored to high-net-worth individuals or classic cars.)

As for preference - Agency choice should be secondary to picking the proper insurance policy for you. Focus on the insurance company, not the agency.

Final Thoughts...

One of the things insurance agents learn about is the difference between intentional and unintentional wrongful acts. (Called Torts!) An important distinction for us to make in this situation is that the insurance companies turning off their website sales funnel is a choice. We can speculate as to why they made the choice, but nonetheless I hope we can all agree it’s a choice. I think this choice negatively affects every Californian because they are dissuaded from obtaining quotes. That’s wrong. Intentionally wrong.

Brian Abbott

January 27, 2024

Our sources

- State Farm, Allstate, Farmers, Kemper, American Family, Nationwide, Travelers, Hartford, Dairyland, Amica, Mapfre, Chubb, and Metromile.